Documentation EN

This document described the integration of the FiskalPRO payment gateway. It is targeted at developers.

For quick integration there is also a swagger document which is available for developers.

Merchant onboarding

Each merchant needs to have created access into the FiskalPRO portal. To enable communication with payment gateway, it is important to specify merchant account information. These data are used in all future payment transactions.

Payment gateway communication is simple. It is needed to send all mandatory fields to the payment gateway by json string on the defined endpoint.

All needed endpoints will be specified for each merchant in the contract.

Authentication

The API uses Bearer token for merchant Authorization. It is needed for creating any payments. It is included in the request header.

Each payment has its own access token, which is created after create payment request.

Testing cards

These cards (Mastercard) are available for testing purposes :

| Card number | Expiry | CVV | OTP code | Description |

|---|---|---|---|---|

5169271104996403 |

1227 | 123 | MC Frictionless | |

5306889942833340 |

1227 | 123 | 1234 | MC Challenge |

5555555555554444 |

1226 | Google Pay |

Payment lifecycle

- Request for the payment. Cardholder browser sends the request for the pay his order by card to merchant.

- Create payment. Merchant sends the request for create payment transaction to FiskalPay.

- Redirect URL with a code. FiskalPay sends a redirect URL with a code back to the merchant.

- Redirect URL. Merchant redirects Cardholder's browser for a new payment.

- Payment completed. IFrame is closed.

- Payment notification. Provider sends payment notification to FiskalPay including payment status.

- Notify merchant. FiskalPay notifies merchant about payment status. Notification of merchant

- Get payment status. Cardholder's browser sends request for payment status to FiskalPay.

- Payment status. FiskalPay sends payment status to cardholder's browser.

Process a payment

As a mandatory field is Bearer token. This token merchant receive during onboarding.

Obtain access code and create payment.

Payment could be realized by two ways (paymentType).

Direct - browser is redirect on url where user could choose payment method and fill needed data.

Email - see Payment by email (Pay By Link)

After the correct payment request is made, the customer is redirected to the FiskalPRO payment gateway.

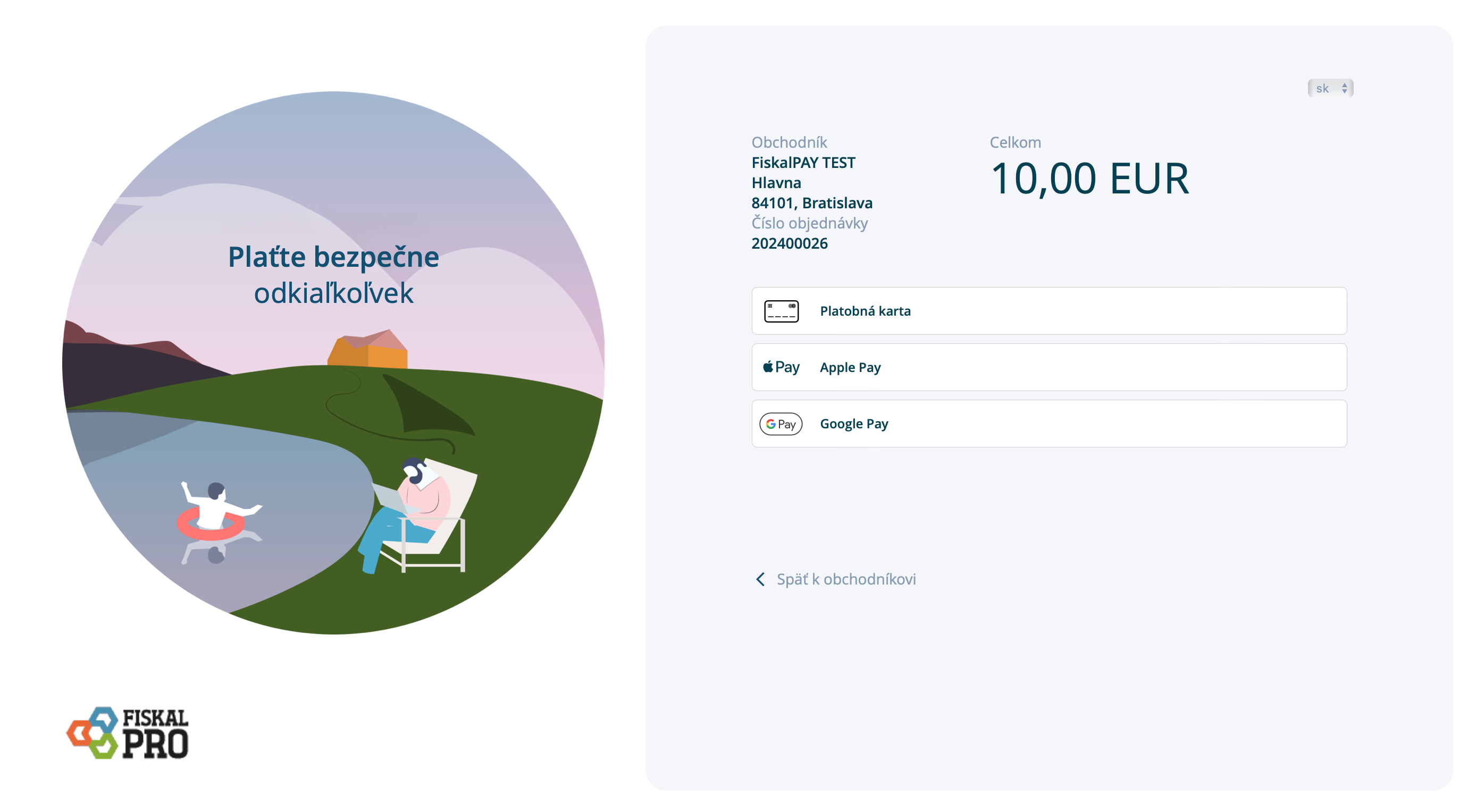

There are three choices, how users can pay.

- by card

- by GooglePay

- by ApplePay

When a user wants to pay later for some reason, there is an option to pay from the payment link, which is send to the user’s email.

At the end of payment, browser receive notification with payment status and redirect to merchant web side.

Payment status and expiration

For payment status see MerchantPaymentStatus

The validity of the payment works as follows according to the type of payment (Default values are given in case of incorrect settings):

Direct payment: Validity is set to 5 minutes. (Default 5 minutes)

Payment by email: The value sent in the EmailTtl parameter is used for email payment. If this value is not specified, the value from the 24h configuration is used (Default 24 hours). The maximum validity value is 31 days. (Default 31 days)

For other payment types: The value is set to 5 minutes.

Validity is not an exact value, but rather a time range When paying directly, the user gets an additional time of 5 minutes in the UI to make the payment on his part. Furthermore, the payment validity check takes place in cycles. Therefore, it is necessary to take into account that the above-mentioned validity values are time data of "minimum" validity and the actual value may be more.

Payments

Standard payments

Customers have to send object PaymentCreateRequestData as a request for creating payment.

Payment response is sent after receiving a payment request. Response contains the url address of the payment gateway, where customers have to be redirected.

Payment by email (Pay By Link)

Email payment is a special type of payment. A new payment URL is generated that can be sent to the customer. In the request to create a payment, you need to set the "paymentType" parameter to "email" and enter the emailTtl value, see Payment request. It has a longer validity period than direct payment, see Payment status and expiration

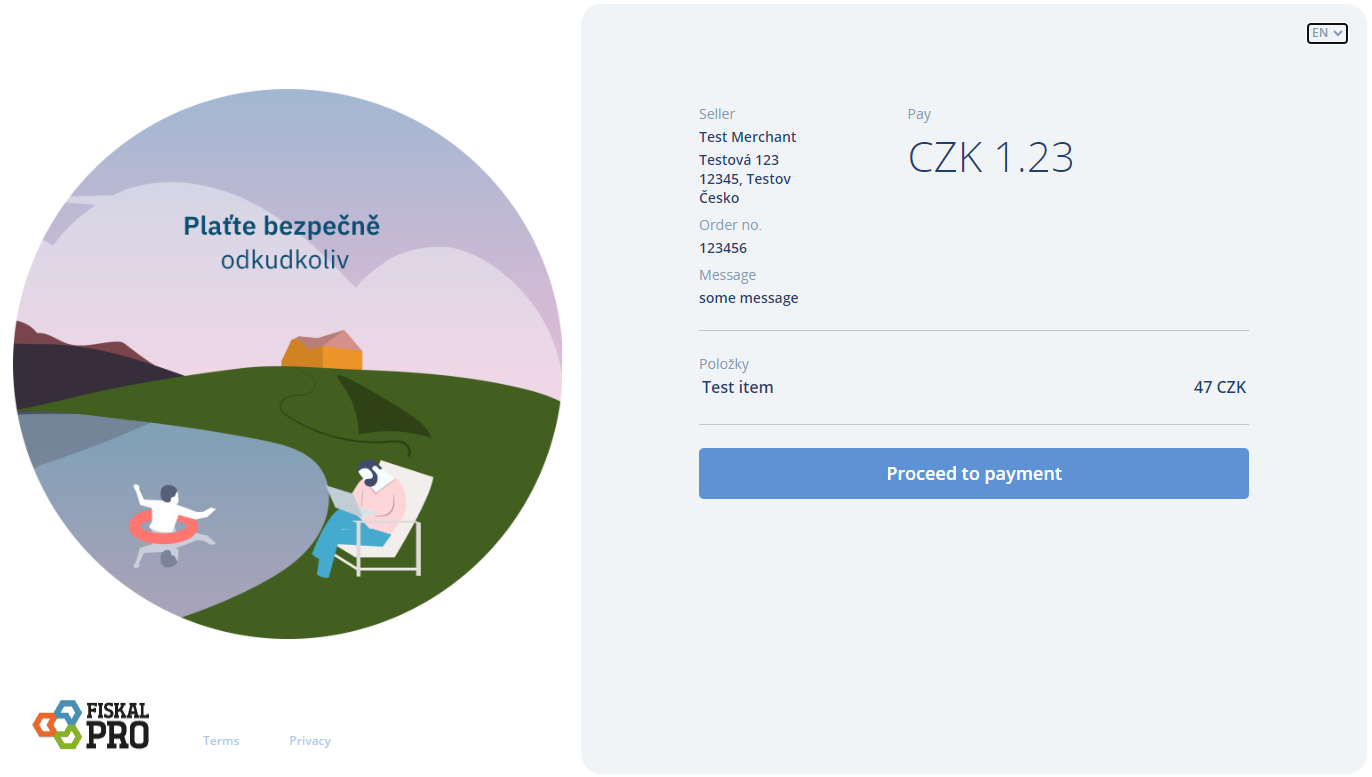

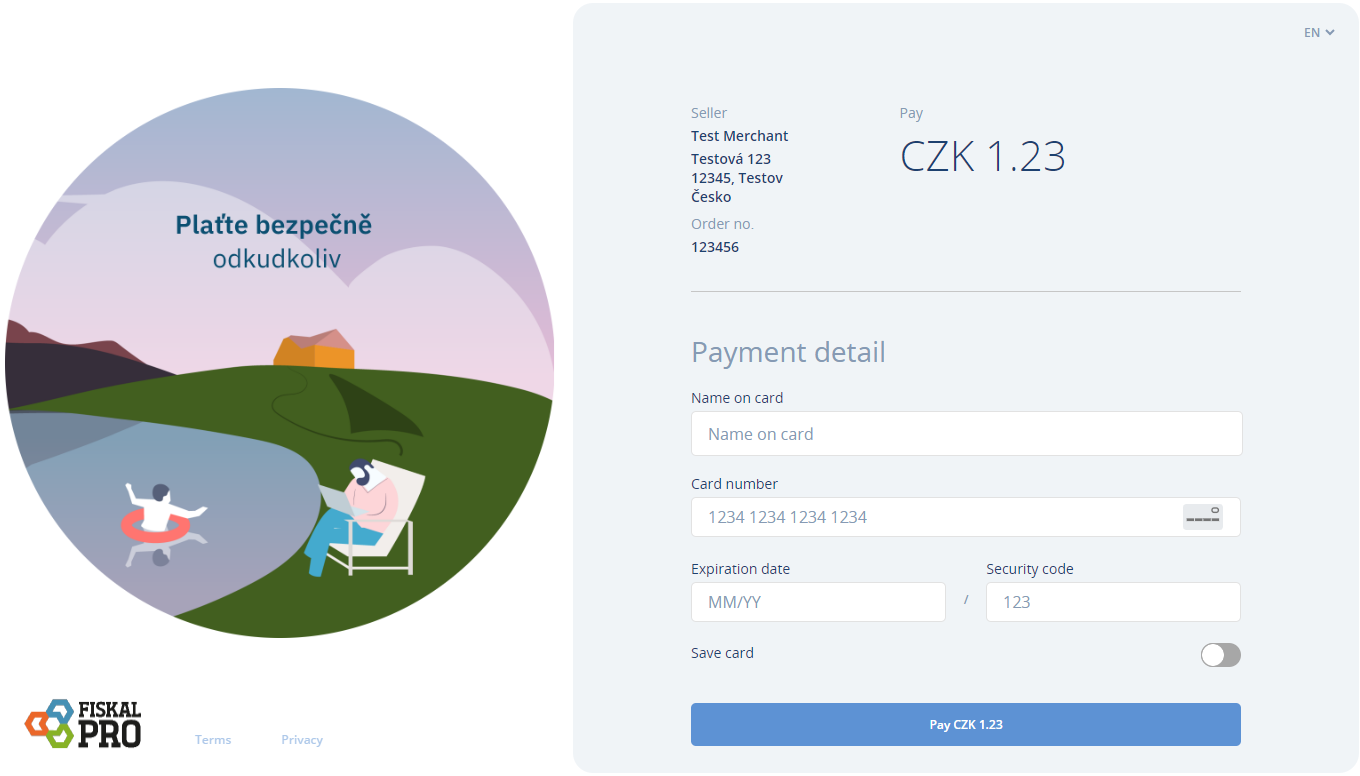

Pay by card

Below is a picture of the FiskalPRO payment gateway, where customers fill all needed fields for successful payment by card.

Here the customer fills the mandatory fields needed for the successful payment. There is support for two languages on the right upper corner - English and Czech for now.

Customer have to fill these fields :

- Name on the card

- Card number

- Expiration date

- Security code

There is also a possibility to save the card for the next usage.

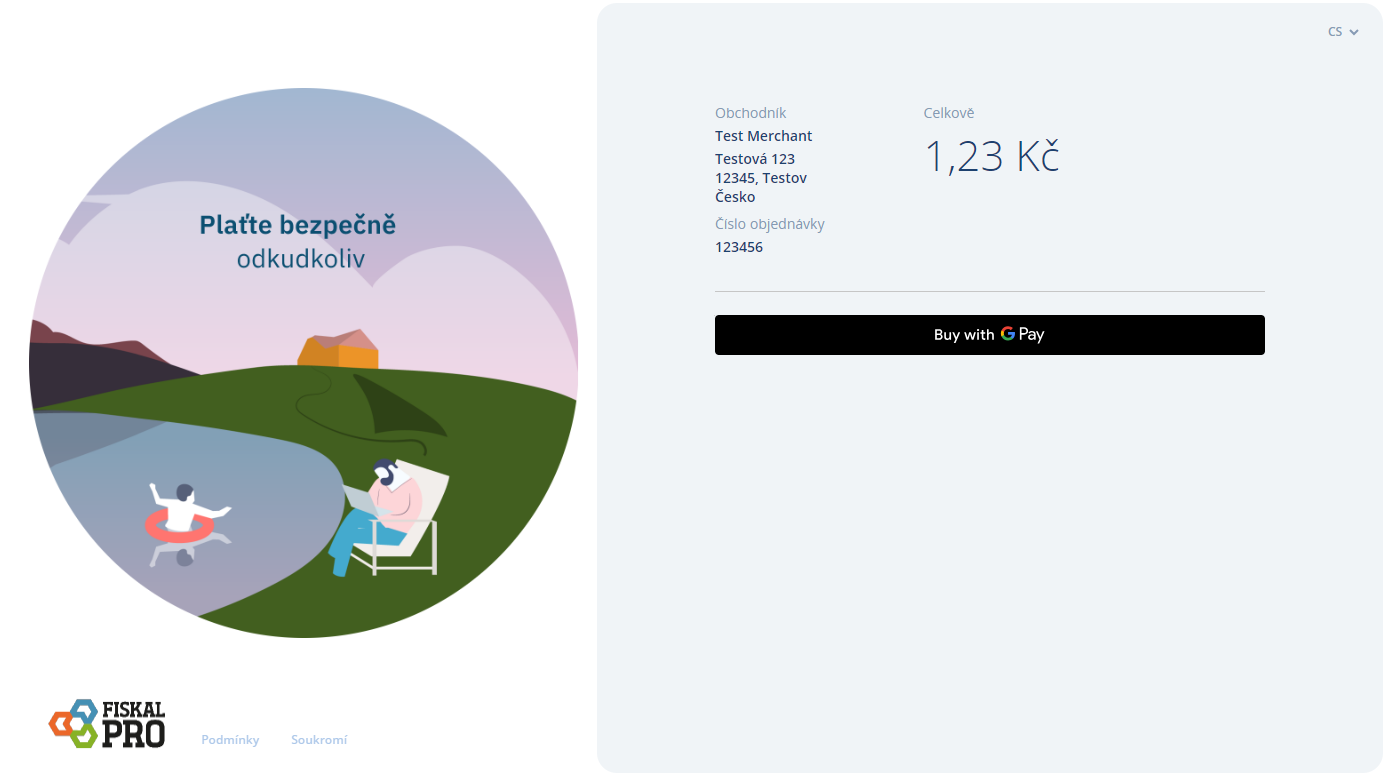

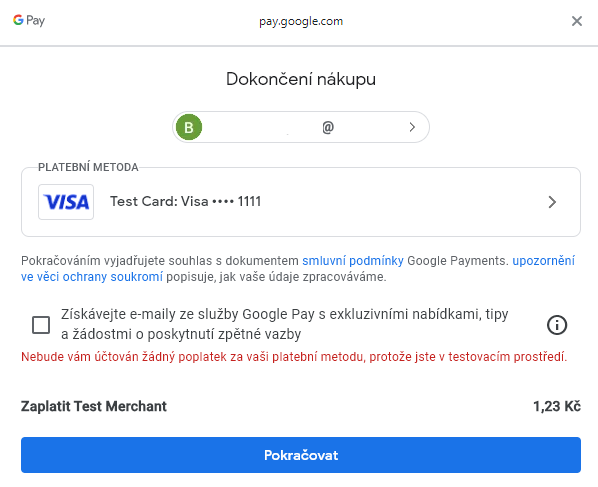

Pay by GooglePay

Next picture shows the screen, when a user selects pay by GooglePay.

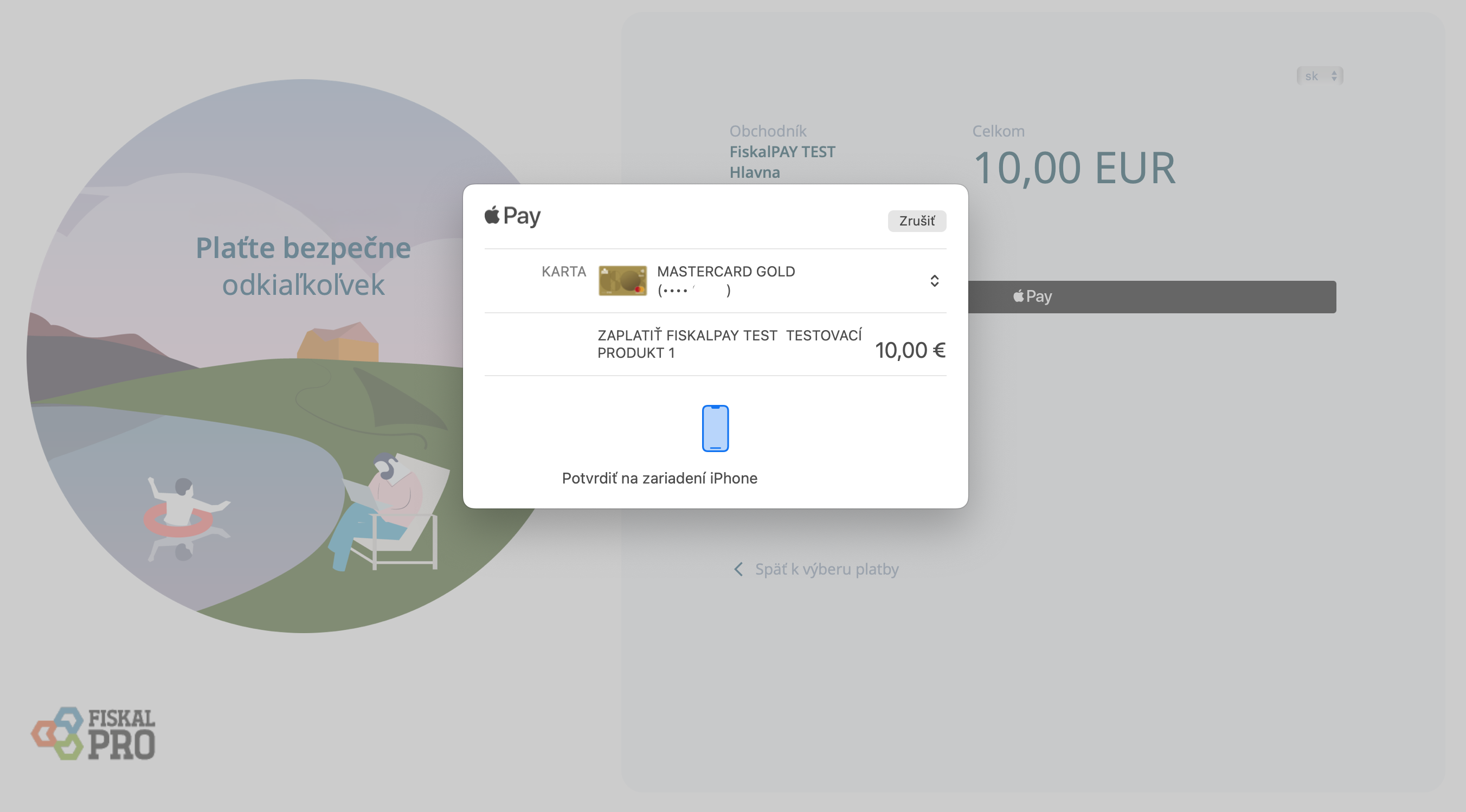

Pay by ApplePay

Next picture shows the screen, when a user selects pay by ApplePay.

Recurring payments

Recurring payments are a special type of payment, for which the procedure is the same as when setting up a normal payment, with the only difference being that the request for setting up the payment contains special data.

When the first payment is established, the payment is made immediately and a scheduler is set to schedule the next payment repetition. The exact time and day the recurring payment is established is important because it is used to calculate the next recurring payment.

The body of the request for establishing a payment must contain the classic mandatory data for a regular payment enriched with the following:

"paymentType" : "Recurrent"

"Recurrence" object

| Key | Type | M/O | The value |

|---|---|---|---|

period |

string | M | with a numerical value, the number of units selected in cycle |

cycle |

string | M | repetition unit -> day, week, month. Note: for month, the setting works in such a way that the payment is always repeated on the same day of the month in which the scheduler was established, and the period value tells how many months it should be repeated |

dateTo |

string | M | date in "YYYY-MM-DD" format, to which the scheduler repeats payments, if the next payment repetition is on the same day or after dateTo, the payment will not be made |

After each payment, a notification should be sent to the merchant with details about the status of the payment, see Payment status notification

Example

{

"paymentType": "recurrent",

"Recurrence":

{

"period":"1",

"cycle":"day",

"dateTo":"2026-10-11"

}

}

API reference

Abbreviations :

- M - mandatory field

- O - optional field.

Payment operations

Payment request

Create payment request

[ POST ] `/api/merchant/payment/create`

Payment request headers

| Key | Type | M/O | Value |

|---|---|---|---|

Authorization |

string | M | Bearer token |

Content-Type |

string | M | application/json |

Accept |

string | M | application/json |

Payment request body

object PaymentCreateRequestData

| Parameter | Type | M/O/C | Max | Description |

|---|---|---|---|---|

merchantPaymentId |

string | M | 36 | Merchant payment ID. |

language |

string | O | 36 | Used language. |

paymentType |

enum | O | PaymentReferenceType |

|

emailTtl |

string | O | Ttl value for 'paymentType' email in the form XY, where X is an integer value and Y is either "h" for hours or "d" for days. If the Y value is not specified, it is set to "d" by default. If this attribute is not filled in, the value in the configuration is used by default. If the value is not configured, the default value of 24 hours is set. Max. the value is 31 days. Example value: "22h" or "14d", or "11". | |

message |

string | O | 128 | Custom message for client. |

amount |

string | M | 12 | The amount of funds requested in the currency of the source location of the transaction. Decimalization of the amount is implied by the value in the currency data element. The amount is shown in the smallest currency units - 1,50 is presented as 150. |

orderNo |

string | M | 16 | Order number. |

basket |

object | M | Customer basket data. |

|

customer |

object | M | Cardholder data. |

|

redirectUrl |

string | M | 1024 | Redirect Url address for redirecting the customer after payment is completed. Min. length 16. |

userId |

GUID | O | 1024 | User ID for the possibility of storing the card on the gateway. |

token |

GUID | C | 1024 | Payment token. Required for OnDemand payment type. |

recurrence |

object | O | For specifications of settings for recurring payment, see Recurring Payments | |

pluginDetail |

string | O | 100 | Detailed information from the plugin. |

Simple payment request example :

{

"merchantPaymentId": "{{payment-guid}}",

"amount": "123",

"orderNo": "123456",

"basket": {

"header": {

"documentNumber": "abc123"

},

"payments": [

{

"paymentId": 2,

"value": 123

}

],

"customer": {

"customerNumber": "58633",

"cardNumber": "495978",

"externalUId": "668855"

},

"items": [

{

"name": "Test item",

"vatRate": 0.21,

"quantity": 2,

"measureUnit": "ks",

"originalUnitPrice": 20.5,

"unitPrice": 23.5,

"priceTotal": 47,

"priceVatBaseTotal": 40,

"priceVatTotal": 7,

"itemRounding": 0

}

]

},

"customer": {

"cardholderName": "Tester Name",

"email": "{{cardholder email}}"

},

"redirectUrl": "https://example.com/merchant-notify-url"

}

Complete payment request example :

{

"merchantPaymentId": "{{payment-guid}}",

"language": "cs-CZ",

"paymentType" : "email",

"emailTtl" : "31",

"message" : "some message",

"amount": "123",

"orderNo": "123456",

"token:": "4ed8df5d-9cc4-42a0-9e86-5405492bb3b9",

"token:": "6a4ee8f2-1636-4f22-a7a9-635d7e9217b5",

"basket": {

"header": {

"documentNumber": "abc123",

"reference": "123456",

"rounding": 0,

"text1": "some text 1",

"text2": "some text 2",

"text3": "some text 3"

},

"payments": [{

"paymentId": 2,

"value": 123,

"description": "payment description"

}],

"customer": {

"customerNumber": "58633",

"cardNumber": "495978",

"externalUId": "668855"

},

"items": [{

"article": "Item 558"

"chr1": "XL",

"chr2": "black",

"ean": "item bar code",

"name": "Test item",

"vatRate": 0.21,

"quantity": 2,

"measureUnit": "ks",

"originalUnitPrice": 20.5,

"unitPrice": 23.5,

"priceTotal": 47,

"priceVatBaseTotal": 40,

"priceVatTotal": 7,

"itemRounding": 0,

"externalUId": "Ext Id",

"text1": "some text",

"textLong1": "some long text"

}]

},

"customer": {

"cardholderName": "Tester Name",

"mobilePhone": {

"cc": "420",

"subscriber": "777123123"

},

"homePhone": {

"cc": "420",

"subscriber": "534123123"

},

"workPhone": {

"cc": "420",

"subscriber": "778123123"

},

"billAddrLine1": "Testing street 51/17",

"billAddrLine2": "second floor",

"billAddrLine3": "flat no. 5",

"billAddrPostCode": "15000",

"billAddrCity": "Praha",

"billAddrState": "10",

"billAddrCountry": "203",

"email": "{{cardholder email}}",

"shipAddrLine1": "Testing street 51/17",

"shipAddrLine2": "second floor",

"shipAddrLine3": "flat no. 5",

"shipAddrPostCode": "15000",

"shipAddrCity": "Praha",

"shipAddrState": "10",

"shipAddrCountry": "203"

},

"redirectUrl": "https://example.com/merchant-notify-url"

}

OnDemand payment

The first time you request a payment, you must create a payment with the OnDemand type. After the customer completes the payment, a token is obtained by asking for the payment status. On subsequent payments you pass the token in the payment request, the payment id will be returned, but no longer the redirect url. The payment will take place without customer interaction. You will be notified when the payment is complete, just like a standard payment.

First OnDemand payment request

{

"merchantPaymentId": "{{payment-guid}}",

"amount": "123",

"orderNo": "123456",

"paymentType": "OnDemand",

"basket": {

"header": {

"documentNumber": "abc123"

},

"payments": [

{

"paymentId": 2,

"value": 123

}

],

"customer": {

"customerNumber": "58633",

"cardNumber": "495978",

"externalUId": "668855"

},

"items": [

{

"name": "Test item",

"vatRate": 0.21,

"quantity": 2,

"measureUnit": "ks",

"originalUnitPrice": 20.5,

"unitPrice": 23.5,

"priceTotal": 47,

"priceVatBaseTotal": 40,

"priceVatTotal": 7,

"itemRounding": 0

}

]

},

"customer": {

"cardholderName": "Tester Name",

"email": "{{cardholder email}}"

},

"redirectUrl": "https://example.com/merchant-notify-url"

}

Second OnDemand payment request - without customer interaction

{

"merchantPaymentId": "{{payment-guid}}",

"amount": "123",

"orderNo": "123456",

"paymentType": "OnDemand",

"token": "4ed8df5d-9cc4-42a0-9e86-5405492bb3b9",

"basket": {

"header": {

"documentNumber": "abc123"

},

"payments": [

{

"paymentId": 2,

"value": 123

}

],

"customer": {

"customerNumber": "58633",

"cardNumber": "495978",

"externalUId": "668855"

},

"items": [

{

"name": "Test item",

"vatRate": 0.21,

"quantity": 2,

"measureUnit": "ks",

"originalUnitPrice": 20.5,

"unitPrice": 23.5,

"priceTotal": 47,

"priceVatBaseTotal": 40,

"priceVatTotal": 7,

"itemRounding": 0

}

]

},

"customer": {

"cardholderName": "Tester Name",

"email": "{{cardholder email}}"

},

"redirectUrl": "https://example.com/merchant-notify-url"

}

Payment info request

[ POST ] /api/merchant/payment/info

Payment info request body

object PaymentInfoRequestData

| Parameter | Type | M/O | Description |

|---|---|---|---|

paymentId |

Guid | M | Payment ID. |

Payment info request example :

{

"paymentId": {{payment-guid}}

}

Create payment response

Payment response body

object PaymentCreateResponse

| Parameter | Type | M/O | Description |

|---|---|---|---|

paymentId |

Guid | M | Payment ID. |

redirectUrl |

string | O | Redirect URL. |

Payment response example (direct) :

{

"paymentId": "18c18413-2b2e-4b98-b08a-442a39b479b1",

"redirectUrl": "https://staging.fiskalpay.eu/?code=d8d16d82-eb5c-48dc-8cf7-add9e67f23f3"

}

Payment response example (email):

{

"paymentId": "33ef6c57-df28-40cf-9395-9b03fa048cfe",

"redirectUrl": "https://staging.fiskalpay.eu/?key=fpk0431b3ff5be374876af50ae7ac283cd0bab2cea077482c130731fd4d5b8e5b7f435f5ef23ca80d2be871468bb98bfc209"

}

Payment response example (OnDemand) - first:

{

"paymentId": "18c18413-2b2e-4b98-b08a-442a39b479b1",

"redirectUrl": "https://staging.fiskalpay.eu/?code=d8d16d82-eb5c-48dc-8cf7-add9e67f23f3"

}

Payment response example (OnDemand) - next:

{

"paymentId": "33ef6c57-df28-40cf-9395-9b03fa048cfe",

"redirectUrl": null

}

Payment info response

Payment info response body

object PaymentInfoResponse

| Parameter | Type | M/O | Description |

|---|---|---|---|

status |

enum | M | MerchantPaymentStatus |

errorMessage |

string | O | Error message if exists. |

token |

guid | O | Payment token for OnDemand payment |

Objects

Basket

| Parameter | Type | M/O | Description |

|---|---|---|---|

header |

object | M | BasketHeader data. |

payments |

collection | O | Collection of BasketPayment. Use the collection only when payment was also made in another way than by card. Transactions made by card are automatically saved. In case of their manual addition, transactions will be doubled. |

customer |

object | M | BasketCustomer data. |

items |

collection | M | Collection of BasketItem. |

BasketHeader

| Parameter | Type | M/O | Max | Description |

|---|---|---|---|---|

documentNumber |

string | M | 20 | Document number. |

reference |

string | O | 10 | Reference variable symbol. Available string format a-zA-Z0-9 |

rounding |

double | O | Document rounding value. | |

text1 |

string | O | 200 | Optional text no. 1 |

text2 |

string | O | 200 | Optional text no. 2 |

text3 |

string | O | 200 | Optional text no. 3 |

BasketPayment

| Parameter | Type | M/O | Max | Description |

|---|---|---|---|---|

paymentId |

short | M | Payment identifier. PaymentId |

|

description |

string | O | 42 | Payment description. |

value |

double | M | Payment value. |

BasketCustomer

| Parameter | Type | M/O | Max | Min | Description |

|---|---|---|---|---|---|

customerNumber |

string | O | 20 | 1 | Customer number. |

cardNumber |

string | O | 32 | 1 | Customer card number. |

externalUId |

string | O | 40 | 1 | Customer external ID (from external SW). |

BasketItem

| Parameter | Type | M/O | Max | Description |

|---|---|---|---|---|

article |

string | O | 14 | Item number. |

chr1 |

string | O | 20 | Item characteristic no. 1 (size, color, etc.) |

chr2 |

string | O | 20 | Item characteristic no. 2 (size, color, etc.) |

ean |

string | O | 20 | Item barcode (EAN). |

name |

string | M | 128 | Item name. |

vatRate |

decim | M | Item VAT rate. | |

quantity |

decim | M | Item quantity. | |

measureUnit |

enum | M | BasketItemMeasureUnit |

|

originalUnitPrice |

double | M | Item original price (before discounts, etc.) | |

unitPrice |

double | M | Item unit price. | |

priceTotal |

double | M | Item price total (unit price * quantity) | |

priceVatBaseTotal |

double | M | Item price VAT base total (tax base). | |

priceVatTotal |

double | M | Item price VAT total value (difference between total price and tax base) | |

itemRounding |

double | M | Item rounding value. | |

externalUId |

string | O | 50 | Item external ID (from external SW). |

text1 |

string | O | 256 | Optional text no. 1. |

textLong1 |

string | O | Optional long text no. 1. Without limit. |

CardHolder

| Parameter | Type | M/O | Max | Description |

|---|---|---|---|---|

cardholderName |

string | M | 50 | Name of the Cardholder. |

mobilePhone |

object | O | The mobile phone provided by the cardholder. CardHolderPhoneNumber |

|

homePhone |

object | O | The home phone provided by the cardholder. CardHolderPhoneNumber |

|

workPhone |

object | O | The work phone provided by the cardholder. CardHolderPhoneNumber |

|

billAddrLine1 |

string | O | 50 | First line of the street address or equivalent local portion of the Cardholder billing address associated with the card used for this purchase. This field is optional, but recommended to include. |

billAddrLine2 |

string | O | 50 | Second line of the street address or equivalent local portion of the Cardholder billing address associated with the card used for this purchase. |

billAddrLine3 |

string | O | 50 | Third line of the street address or equivalent local portion of the Cardholder billing address associated with the card used for this purchase. |

billAddrPostCode |

string | O | 16 | ZIP or other postal code of the Cardholder billing address associated with the card used for this purchase. This field is optional, but recommended to include. |

billAddrCity |

string | O | 50 | The city of the Cardholder billing address associated with the card used for this purchase. This field is optional, but recommended to include. |

billAddrState |

string | O | 3 | The state or province of the Cardholder billing address associated with the card used for this purchase. The value should be the country subdivision code defined in ISO 3166-2. This field is optional, but recommended to include. |

billAddrCountry |

string | O | 3 | The country of the Cardholder billing address associated with the card used for this purchase. This value shall be the ISO 3166-1 numeric country code, except values from range 901 - 999 which are reserved by ISO. This field is optional, but recommended to include. |

email |

string | M | 256 | The email address associated with the account that is either entered by the Cardholder, or is on file with the 3DS Requestor. This field shall meet requirements of Section 3.4 of IETF RFC 5322. |

shipAddrLine1 |

string | O | 50 | First line of the street address or equivalent local portion of the shipping address associated with the card used for this purchase. This field is optional, but recommended to include. |

shipAddrLine2 |

string | O | 50 | Second line of the street address or equivalent local portion of the shipping address associated with the card used for this purchase. |

shipAddrLine3 |

string | O | 50 | Third line of the street address or equivalent local portion of the shipping address associated with the card used for this purchase. |

shipAddrPostCode |

string | O | 16 | ZIP or other postal code of the shipping address associated with the card used for this purchase. This field is optional, but recommended to include. |

shipAddrCity |

string | O | 50 | City portion of the shipping address requested by the Cardholder. This field is required unless shipping information is the same as billing information. This field is optional, but recommended to include. |

shipAddrState |

string | O | 3 | The state or province of the shipping address associated with the card used for this purchase. |

shipAddrCountry |

string | O | 3 | Country of the shipping address requested by the Cardholder. This value shall be the ISO 3166-1 numeric country code, except values from range 901 - 999 which are reserved by ISO. This field is required if Cardholder Shipping Address State is present and if shipping information is not the same as billing information. This field is optional, but recommended to include. |

CardHolderPhoneNumber

| Parameter | Type | M/O | Max | Description |

|---|---|---|---|---|

cc |

string | O | 3 | Country Code of the phone. Min. length 1. |

subscriber |

string | O | 15 | Subscriber section of the number. |

Enums

PaymentReferenceType

| Enumeration: | |

|---|---|

Direct |

default, direct link to payment |

Email |

deferred link |

Test |

test the payment and validity, payment will not be deposited |

OnDemand |

Payment on request |

Recurrent |

Recurrening payment |

PaymentId (in BasketPayment object)

| Possibilities: | |

|---|---|

1 |

cash (cannot be used in this API) |

2 |

card payment |

3 |

voucher (probably will be used in the future) |

BasketItemMeasureUnit

| Enumeration: | |

|---|---|

Ks |

piece |

L |

liter |

Ml |

milliliter |

Pár |

pair |

G |

gramme |

Kg |

kilogram |

Cm |

centimeter |

M |

meter |

Hod |

hour |

Hl |

hectoliter |

Bal |

packaging |

T |

ton |

M2 |

square meter |

M3 |

cubic meter |

Dcl |

deciliter |

MerchantPaymentStatus

| Enumeration: | |

|---|---|

Created |

payment was established |

New |

initial state, submitted for processing |

Authorized |

approved by issuer |

Declined |

not approved by issuer |

Reversed |

payment was cancelled |

Captured |

funds were received |

Error |

error during payment |

Recurrence

| Key | Type | M/O | The value |

|---|---|---|---|

period |

string | M | with a numerical value, the number of units selected in cycle |

cycle |

string | M | repetition unit -> day, week, month. Note: for month, the setting works in such a way that the payment is always repeated on the same day of the month in which the scheduler was established, and the period value tells how many months it should be repeated |

dateTo |

string | M | date in "YYYY-MM-DD" format, to which the scheduler repeats payments, if the next payment repetition is on the same day or after dateTo, the payment will not be made |

Notification of payment status

Notifying merchant about payment status is addressed to NotifyUrl sending notification JSON object containing paymentId and status.

Body of that request looks like:

| Parameter | Type | M/O | Description |

|---|---|---|---|

PaymentId |

Guid | M | Payment ID |

Status |

string | M | String value MerchantPaymentStatus. If the payment status would be Expired => status = Error |

Description |

string | O | Description string value for status Expired => "Payment link expired". Otherwise, the value is not populated |

StartPaymentId |

Guid | O | Identifier of the payment that triggered the recurring payment command. Otherwise, the value is not populated |

Notification verification

While sending notification about payment status in a body of request, there is also possibility to ensure notification authenticity via notification signature in a header of request. The notification signature has key Signature and its value is hashed string. This hashed string was made with two parts: parameters of notification object from body and as key was used SignatureSalt which was automatically generated and returned in response body when MerchantMethodTerminal was created. If you lost this SignatureSalt value there is way to generate new one via sending POST request to endpoint merchants/{merchantId}/methods/{methodId}/terminals/{terminalId}/regenerate.

To verify notification authenticity follow these steps:

Calculate own signature Combine the parameters of recieved notification body as string like this ${{htmlContent}}quot;{paymentId}{status}". This value needs to be hashed (HMAC) using SHA256 algorithm and SignatureSalt value as key to hash. Last step is to remove "-" character from string. Final result should be string with uppercase letters and be 32 Bytes long

Compare Compare generated hashed code with recieved one in header of request